CASH, CONTROL AND CERTAINTY FOR THE BUSINESS OWNER.

A Buy/Sell Agreement, (also known as a Buyout Agreement, or Business Continuity Agreement) is a contract that in the event of death, disability or a serious trauma of a shareholder or key person provides for:-

- The sale of an owner’s share of a business.

- Repayment of business debts and loans.

- Repayment of shareholders’ current accounts.

- Compensation for lost profits due to key person loss.

- Funding for key person replacement.

Such an agreement provides you and your business, and your family with:-

- CASH – when it is needed for share transfer funding, company debt repayment, elimination of personal guarantees and replacement of lost income in the event of a short or long term loss of an owner and/or key person.

- CONTROL – of the company, offering protection against attacks by predators, creditors, receivers and unwelcome shareholder heirs.

- CERTAINTY – of outcome for the family(ies) and the business, providing financial security and peace of mind.

The main reason to draft a Buy/Sell Agreement is that “hope” is not a good business strategy. If you don’t have a robust Business Continuity Agreement in place when it is needed (a bit like not having a parachute when you fall), a number of unwelcome outcomes are quite likely to occur.

- The business could wind up in the wrong hands, such as a bereaved spouse of a former business partner fighting to protect the financial future of his/her family.

- Financiers are likely to demand repayment of company loans, if the money is not available in the company, a demand could be made on personal assets or the estate of a deceased shareholder.

This could lead to the sale of personal assets, maybe liquidation of the company and personal bankruptcies. - Your business could die in the courts while surviving owners or heirs are contesting their rights and entitlements.

Even if you manage to obtain a successful outcome in the courts, the resulting costs in time and money could be unsustainable. - Without specifying a ready buyer for your business in advance, you or your heirs may not receive fair compensation when you exit.

- If you or your heirs are forced to find a buyer for the business on short notice, expect the sale price to be far below fair market value.

A bespoke, comprehensive Buy/Sell agreement will eliminate these risks and provide CERTAINTY of outcome for you.

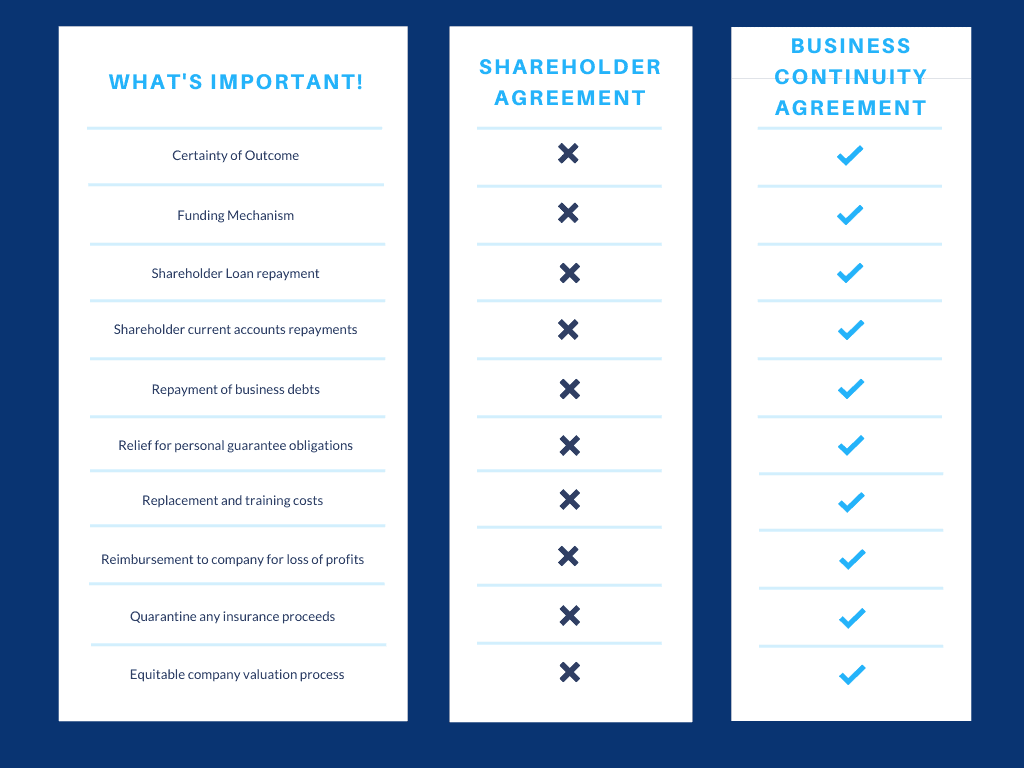

A Shareholder Agreement normally does not provide the desired certainty of outcome; but normally provides only OPTIONS.

Why does a Buy/Sell Agreement provides better CERTAINTY of outcome over a Shareholder Agreement?

Will your Shareholder Agreement or Buy/sell Agreement provide you with the necessary certainty of outcome, financial security and peace of mind?

Take advantage of our FREE Shareholder Agreement audit

These are some of the issues that need to be addressed in an agreement:-

Share transfer funding

- When an owner of a business passes away, unless there is an agreement in place, their share of the business passes to their heirs. A robust agreement ensures that the shares end up in the right hands and protects the affected family and the ongoing value of the business as well as the surviving shareholder’s business interests.

- If your business partner dies, do you want to be in business with his/her spouse’s new life partner’s accountant and lawyer?

- If you die or become disabled, would your widow/er want to have to rely for an income in the future on a partial share of an uncertain profit from a business (in which she/he probably has little interest) and is now missing a key person (you) – or would she/he prefer a fair cash settlement to invest and to provide for your family’s future financial well-being?

- A robust agreement specifies a fair price for the business while there is still a level playing field, and determines how the company should be valued and who gets the money. This ensures that surviving business owners and the heirs of an affected shareholder all get fairly compensated if the agreement is triggered.

- The money is protected from predators and creditors by an independent trustee.

Personal Guarantees;

Most personal guarantees to secure business debts are “Joint and Several”. This means that all signatories may be held responsible for the whole of the debt. In the event of the death or serious disablement of a business owner who is a key person, a financier may well demand repayment of a business loan in full or in part from the estate of the deceased partner or the personal assets of any of the surviving signatories to the personal guarantees if they feel that the financial stability of the business has been compromised by the tragic event.

It is important to appreciate that a personal guarantee survives death and is a prior charge on the deceased’s estate.

This means that the deceased’s estate may not be probated until all personal guarantees are satisfied. This can delay settlement of an estate for many months, or even years – usually with huge legal costs and may result in the loss of the family home.

Shareholders’ Current accounts

These loans are repayable on demand, and if provision is not made for their repayment they can in some cases ultimately cause the business to trade insolvently, leading to possible liquidation and the demise of a business, and possible personal bankruptcy for surviving shareholders as personal guarantees and loans are called on by the liquidators. ( I have had personal experiences of this.)

Key Person – loss of profits and key person replacement

- All business enterprises, whether small, medium or large depend upon specific personnel who are central to the company’s continued viability and success. These are Key People.

- It is common sense to protect business proprietors and their families against the loss of these key people.

- However, there is also a legal duty upon Company Directors and Trading Trustees that their business remains solvent and able to meet its financial obligations under all circumstances.

- This would include the unexpected loss of a proprietor or employee who is a key person. (Companies Act 1993)

- People and revenue are the lifeblood of every business and the two are inextricably linked; i.e. revenue depends on people and people depend on revenue.

- If a business is to be able to continue trading following the sudden unexpected loss of personnel to a serious life risk (i.e. disablement, trauma or death), it must remain solvent and able to continue meeting its financial obligations as well as maintain shareholder value, or it can be placed into receivership and possibly liquidated.

- In order to achieve these objectives, it is vital that those personnel central to the business’s continued viability are identified before the fact and the downstream effect of their loss understood and planned for.

- The business should have a Business Continuity Plan that ensures that business revenue can be preserved, lost personnel replaced, debts repaid and personal guarantees extinguished (particularly if so required by creditors and lenders) and all other contingencies provided for. These factors are all too often underestimated or overlooked.

Please note:- Directors have a fiduciary responsibility to their shareholders and creditors to immediately address any identified issues for which funding facilities are not presently available.

The first and possibly most important issue to address in maintaining the company’s solvency and ability to continue trading, is to ascertain the level of revenue that is at risk and to have a strategy in place to preserve that revenue. In ascertaining this, it must be established who is responsible for the three main tasks of:-

- Sales and business relationships,

- Management and

- Specialist functions.

To assess the financial risk profile of a business, and to help the shareholders understand the impact these risks could have on the business value and the financial security of the shareholders and their family, we offer a Business Financial “MRI” Scan (Major Risk Identifier) which also offers a range of recommendations to assist qualifying businesses in mitigating these risks – at my cost.

Book a chat with Barry today to discuss how a Financial MRI Scan will benefit YOUR business.

I specialise in providing my business clients with a planned exit strategy to ensure that the partners and their families have the outcome that they desire, which provides them with peace of mind and financial security.

Contact me today to find out more about how you can plan a robust, equitable Business Continuity Plan with an effective, funded shareholder Business Continuity Agreement.

CASH

CONTROL

CERTAINTY

Barry Vincent – Business Continuity and risk specialist-

Book a chat with Barry today – CLICK HERE to book

Case study – How Bill ended up in business with his partner’s wife Mary!

Sounds confusing?

You see Bill and Tom had worked together in their successful electrical engineering business for many years. They started with the minimum of tools, a lot of talent and some big plans.

Together they grew A1 Electricians Ltd into a very successful and profitable business. They worked well together with Bill focussing on sales and management, and Tom working mainly in operations. Their skills complimented each other.

Then unexpectedly tragedy struck. Tom was driving home late one night and was involved in a head on collision with a drunken driver, and unfortunately 24 hours later he died from injuries suffered in the accident. A real tragedy – he just happened to be in the wrong place at the wrong time.

Mary, Tom’s stay at home wife and the mother of his two children, inherited Tom’s shares in the business and effectively became Bill’s business partner. To say the least this was not a happy relationship, especially after Mary insisted on appointing her totally unsuitable interfering brother to be her representative.

Unfortunately Bill didn’t have the resources to buy out Mary’s shares and the business really suffered after it lost Tom’s skills and operational acumen. Two years on, after a lot of arguing about direction and a loss in value, the business was in a “forced sale” situation; sold to a competitor at a highly discounted rate as by that time Bill had lost interest and just wanted out.

This unfortunate chain of events could easily have been prevented with some planning and professional advice from the knowledgeable team at Wealthbuilders Ltd.

This is just one example of how a simple and affordable, back to back shareholder protection Business Continuation agreement and associated funding insurance cover would have avoided this unfortunate situation. With the insurance proceeds Bill could have paid a fair price to Mary for Tom’s shares and then recruited a suitable manager with good operational skills to replace Tom in the business. If this had happened there is every likelihood the business would have survived and indeed grown.

Business continuance and succession planning should be a vital ingredient in any business partnership with regular reviews to ensure risk management measures remain suitable as the business grows.

Trauma in Buy/sell agreements.

Trauma is statistically the most likely tragic event for the owners of a business to face. It should not be ignored as part of the agreement and funding package. It is difficult but not impossible to implement, however the owners must have full understanding of how it can work.

The effects of a major trauma occurring to a shareholder’s ability or desire to work vary considerably, and must be taken into account.

If the event is a serious and ongoing illness or injury, an exit from the business is a likely eventual outcome. The owners have also given themselves a window within which to make that decision. This is commonly called a “Sunset Clause” and is usually a six month period. A decision should be made within that period, depending on the level of recovery and also the wishes of the sufferer who may decide they have no wish to continue in the business, or the affected shareholder decides to stay in the business.

- Insurance claim benefits have been paid out to the policy owner.

- No shares have been transferred.

- The affected shareholder is staying in the business

What are the parties going to do with the funds?

How to build trauma into the portfolio given that a trauma claim doesn’t trigger an owner’s exit from the business.

Successful Business Succession planning ensures that an estate receives full, fair and a pre-agreed payment for the value of the exiting owner’s shares. In return, the estate signs over the shares or equity in the business to the remaining shareholder(s). In either of the above trauma scenarios the agreement needs to ensure that an outcome which is tidy and is fair to all parties – including the business itself, even if there has not been a death or Total and Permanent Disability.

Structuring the buy/sell agreement relies on all the parties agreeing on the alternative strategies that the agreement will embody as well as the ownership of the policy(ies).

Cross ownership of the policies is the usual ownership method.

However, this is NOT the ideal way to handle the policy ownership, as it becomes confusing and unwieldly, particularly when applied to companies with more than two shareholders.

More importantly, it is open to abuse and does not provide a certain and predicable outcome for the shareholders and their families.

Trauma scenario under cross ownership.

- Fred survives a heart attack.

- Frank receives a large sum of money.

- Fred recovers and comes back to work.

- He has his equity in the business and no need nor intention of handing that over to Frank.

- However, Frank has a lump of money that was designed to compensate Fred for transferring his equity to Frank.

- Fred has no bargaining power at that point.

- He has suffered a trauma and undergone a claims assessment process.

- His business partner has the benefit monies, but he still owns his shares and returns to work.

- Frank also retains his shares, and also has the money.

- Spot the error in that equation!

Trauma scenario under SELF ownership.

- Fred and Frank own their own policies.

- Claim proceeds go direct to Fred after his heart attack.

- He returns to work.

- He also has a lump of money that was funded with premiums paid for by the business.

- He has enjoyed a windfall that may well be in addition to his personal trauma cover.

- There is unfairness in this too.

In both of these scenarios, either party could benefit privately from a transaction that was designed to ensure business continuity, and so was a business, not a personal, strategy.

The the buy/sell agreement must determine that those proceeds, if not used for the original purpose, are disposed of o in a way that satisfies everyone that the business has in some way benefited.

The preferred option for policy ownership

- An Insurance (or bare) trust owns the policy(ies)

- The proceeds are paid to an independent trustee who will administer the proceeds in accordance with the provisions of the buy/sell agreement.

- The same decisions as in the previous ownership options need to be considered and incorporated into the Buy/sell agreement.

The owners need to agree on which strategy to build into the agreement. That’s where the adviser has such an important role to play. An experienced lawyer has the capacity to talk through all these alternatives with the owners, but it is up to the adviser to engage the owners in the need for such solutions and get them in front of the lawyer.

Complimentary -“Buy/Sell Agreement Planning Guide and template”

TAKE ACTION

CASH – when you need it

CONTROL – of your business

CERTAINTY – of financial security for your family

Book a chat with Barry TODAY to start planning how you can achieve peace of mind by safeguarding your business value and your family’s financial security – CLICK HERE

Barry Vincent – Business Continuation and Business Insurance Specialist

Financial Adviser FSP294626